A fuel refueling car at a gas station / Reuters

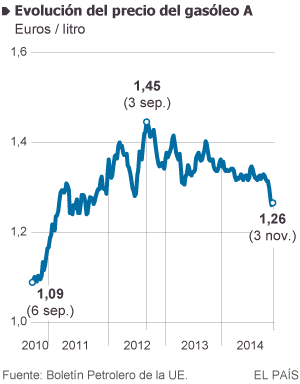

The Brent oil, the European benchmark, which is now at least, the price touched highest this year on June 19. The barrel cost in international markets $ 115.06. Since then, oil prices have declined 32% to about $ 78 to those trading Thursday, its lowest level in four years. During the same period, the fuel has also declined, but less. Gasoline is now worth 1.33 euros per liter, 7.6% less. The diesel costs 1.26 euros, 6% lower than nearly five months ago. In any case it is not even close, its lowest price in four years.

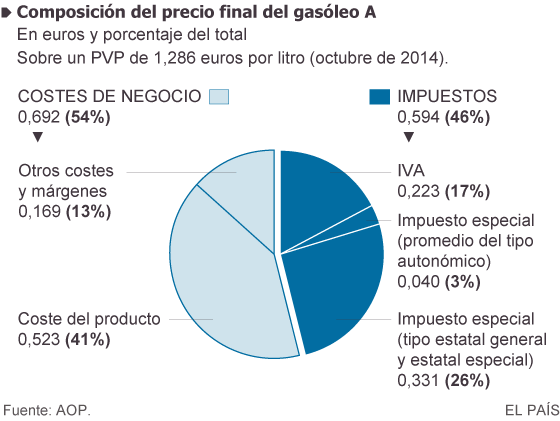

Why not arrive with the unabated decline of oil to gas stations? Companies producing justify oil as raw material, is responsible for less than 40% of the price of gasoline. Before becoming gasoline, crude runs a long chain in which every link a profit margin fall. Extraction, refining, transportation, wholesaling, sales at gas stations … In addition, the departure of taxes accounted for 46% of the final price

The Spanish Association of Oil Product Operators (AOP) argues that, taking reference to the average price of diesel in October from 1.28 euros per liter, 0.59 euros went to taxes. 0.16 euros is the other distributors and marketers were, among others. And only 0.52 Euros is what was used to pay for petrol and diesel, both raw material-which has dropped to minimum prices in four years as refining

“The supplier follows the movements of the cost of supply, both increases and downhill, “he said in his analysis of the bosses October prices. Remember also that the price statistics of the European Union published refer to data collected last week, so the stations have data regarding the delay generated daily on the stock of raw materials.

The last time crude was $ 78, four years ago, diesel was worth 1.08 euros. It now costs 26 cents more. Why? Currencies also have an important role in fuel. Four years ago, with much stronger euro, dollar buying barrels cheapened costs for Europe.

Is it then fair price? The AOP devotes much of his communications to defend the suspicions of excess margin sector, especially since the accused Competition in 2012 to implement the rocket-boom effect: high oil prices go up like a rocket to the suppliers, but downhill, the speed of a falling feather.

Currently the fuel sector remains one of the main focuses of the regulator, the CNMC. At Easter gave a report to highlight the traditional “price spike” that apply to rental companies. In April, another analysis reported that margins are bagged gas stations in Spain have grown in the last year while in the rest of Europe, were stable. And in May stated that companies had returned to practice called ‘Monday effect’, ie, lower prices at the beginning of the week and upload them as you go.

No comments:

Post a Comment