José Miguel García (left), CEO of Jazztel, along with Leopoldo Fernández Pujals, president of the company. / AP

The concentration process telecommunications is accelerated in Spain. Just two months after closing the purchase of Vodafone Ono by 7,000 million euros, is now Orange who will launch a friendly takeover offer for 100% stake in Jazztel. The French group offers 13 euros per share, valuing the company 100% in about 3,400 million euros. That figure represents an 8% premium over the price at which trading was suspended yesterday by the National Securities Market Commission (CNMV) when shares rose 12%. The supervisor will investigate the apparent insider trading. Orange indicates that the premium is 34% on a weighted average of the last 30 meetings.

Jazztel announced the deal shortly before 11 pm Monday. Orange offers 13 euros per share to pay cash and pledges to launch its offer to acquire 100% of the capital. Leopoldo Fernández Pujals, chairman and largest shareholder with 14.48% Jazztel, agrees to accept the offer of the French group. Pujals commitment is maintained even competing bids are submitted whenever Orange decided improvement. Jazztel CEO, José Miguel García, and Secretary General, José Ortiz, also support the offer and agree to accept it.

The Orange offer is conditional upon obtaining the authorizations not should be a problem, since the bid is accepted by more than 50.01%, without computing Pujals actions. In addition, the Orange conditional on Yoigo Jazztel not buy, the fourth mobile operator, an operation that was looking

.

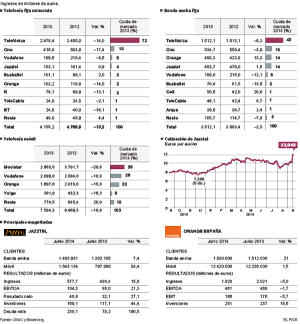

The Spanish telecommunications market.

Orange will increase capital by a maximum of EUR 2,000 million and issue perpetual subordinated debentures hybrid so it is not affected your credit score. The French company said in a statement that the transaction will generate synergies 1,300 million for union with the operations of its Spanish subsidiary. The savings will focus on operational costs and investments in network. Given the synergies, estimated Orange price equal to 8.6 times EBITDA in 2015.

The Orange French group has been studying the possibilities of growing years through acquisitions in Spain, where Ya.com already purchased, a subsidiary of Deutsche Telekom. Lately he had no qualms about openly acknowledge their buying position. Earlier this month, its chief financial officer in Spain, Federico Colom said at a conference held in Santander telecoms his group was willing to participate in any process of buying or Jazztel Yoigo, the fourth mobile operator, whenever ” offered for sale. “

Pujals, founder of Telepizza, as demonstrated by the sale of the fast food chain is not in business for sentimental reasons. However, has tried to find the optimal time to achieve the highest possible price in the sale. Within a decade he has managed to turn a company that seemed to drift and has multiplied its value in record time.

Stocks Jazztel have risen over 54% so far year and have increased 10 price in just six years. Leopoldo Fernández Pujals, who became president after investing just over 60 million in the company, would get around about 500 million euros from the sale of its stake.

Buying Ono by Orange Vodafone got pressure, with the purchase of Jazztel Strikes and can add 1.5 million customers and many other mobile broadband. With this, gets second place in Spanish broadband market. Jazztel is the operator that has experienced the greatest growth in broadband in recent years and has a valuable network.

No comments:

Post a Comment